Mortgage calculator extra payment current balance

Current Mortgage Rates Up-to-date mortgage rate data based on originated loans. And an extra payment of 400 for months 7-36 you enter 100 for months 1-6.

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Best Mortgage Lenders Independently researched and ranked mortgage lenders.

. 30-Year Fixed Mortgage Principal Loan Amount. Accurate data to begin with gives an accurate answer. Make payments weekly biweekly semimonthly monthly bimonthly quarterly or.

Equity after 5 years. Make sure the payment is principal and. Interest youve already paid.

Years to pay off. The calculator lets you find out how. Found on the Set Dates or XPmts tab.

Mortgage Payoff Calculator 2a Extra Monthly Payments. Start by entering the mortgage amount. The CUMIPMT function requires the Analysis.

Whatever the frequency your future self will thank you. Equity Built 5 Years. September 11 2022 Monthly mortgage payments.

Then choose one of the three options for enteringcalculating the number of mortgage payments made leave two of the options blank and click the Calculate Mortgage Balance button to return your current balance loan payoff amount. Estimate your monthly payment with our free mortgage calculator and apply today. This is the cost of the home minus the down payment.

It could be one extra mortgage payment a year two extra mortgage payments a year or an extra payment every few months. This one is smart enough to take that into consideration and use only your current balance loan rate and payment amount. Mortgage Amount or current balance.

Pay this Extra Amount. To calculate how long it will take for the mortgage holder to pay off the average mortgage set up the calculator this way. A mortgage calculator is a smart first step to buying a home because it breaks down a home loan into monthly house payments based on a propertys price current interest rates and other factors.

For your convenience current 15-year Redmond mortgage rates and 30-year Redmond mortgage rates are published to help you compare loan scenarios and find a local lender. Adjust down payment interest insurance and more to start budgeting for your new home. The term of the loan and the mortgage interest rate.

Equity after 10 years. You decide to increase your. Calculate the difference in total interest paid on a mortgage loan when making additional monthly payments.

To estimate how much time and interest you can save use our extra mortgage payment calculator. Enter the mortgage principal annual interest rate APR loan term in years and the monthly payment. If you have made any extra payments you can find the period remaining by clicking here and entering your current balance rate and monthly payment.

Calculate your monthly mortgage payment with current. Since creating this spreadsheet Ive created many other calculators that let you include extra mortgage paymentsThe most advanced and flexible one is my Home Mortgage Calculator. Extra Payment Mortgage Calculator.

About Dates Interest Calculations - In the real world the time between the mortgage origination date and the first payment due date will seldom be equal to the payment frequency. You have a remaining balance of 350000 on your current home on a 30-year fixed rate mortgage. You can save a lot of interest if you pay down the loan earlyThis extra payment calculator is designed to tell you how much interest and time youll save if you.

Mortgage Monthly Payment Extra 50 Extra 100. The mortgage early payoff calculator will show you an amortization schedule with the new additional mortgage payment. First Payment Due - due date for the first payment.

Make sure the payment is principal and. Mortgage Calculator Found a home you like. If your current rate on a 30-year fixed loan is 4000 would you like to see.

Starting from the first year of your loan. Loan Balance 5 Years. Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculator.

You can also see the savings from prepaying your mortgage using 3 different methods. If you enter your current mortgage balance in the Loan Amount then enter the number of years you have left on your mortgage. Mortgage calculator - calculate payments see amortization and compare loans.

When you pay extra on your principal balance you reduce the amount of your loan and save money on interest. Current approximate balance of your mortgage. Loan Original Payment With 13th Payment Each Year.

Results Current Current Plus Extra Bi-Weekly Bi-Weekly plus Extra Mortgage payment. The balance of the home loan or mortgage to be paid off. Current Redmond mortgage rates are published.

Lets say you have a 220000 30-year mortgage with a 4 interest rate. Jan-11-2023 Payment 5 95483 66281 29203 Feb-11-2023 Payment. 360 original 30-year term Interest Rate Annual.

Even a little can go a long way. Maintain these additional payments over an extended period of time and youll likely eliminate several years from your term. This is calculated as the home price less the down payment.

Use this additional payment calculator to determine the payment or loan amount for different payment frequencies. You will get a comparison table that compares your original mortgage with the early payoff. For your convenience current Redmond mortgage rates are published below.

Current mortgage payment less escrow. You can also use the calculator on top to estimate extra payments you make once a year. And an extra payment of 400 for months 7-36 you enter 100 for months 1-6.

Your mortgage can require. Historical Mortgage Rates A collection of day-by-day rates and analysis. Our mortgage payoff calculator can show you how making an extra house payment 1050 every quarter will get your mortgage paid off 11 years early and save you more than 65000 in interestcha-ching.

If you are a Scotiabank mortgage customer depending on the mortgage solution that you select each year you can increase your scheduled monthly payments by up to 10 15 or 20 of the payment initially set for your term or in some cases your current payment and make a lump sum prepayment of up to 10 15 or 20 of your original principal. If you want to make an extra payment each month to pay off your mortgage use the mortgage payoff calculator extra payment. The Vertex42 Mortgage Payment Calculator is a very simple spreadsheet that lets you compare different mortgages side-by-side.

In just 4 simple steps this free mortgage calculator will show you your monthly mortgage payment and produce a complete payment-by-payment mortgage amortization schedule. If you have made any extra payments you can find the period remaining by clicking here and entering your current balance rate and monthly payment. Mortgage Closing Date - also called the loan origination date or start date.

Calculate your monthly payment here. Interest Pay Extra. For example lets say youre considering purchasing a 250000 home and putting 20 percent down.

Mortgage Payoff Calculator 2a Extra Monthly Payments. For Excel 2003. Monthly payments start on.

Free Interest Only Loan Calculator For Excel

Extra Payment Calculator Is It The Right Thing To Do

Mortgage Payoff Calculator With Extra Principal Payment Free Template

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Extra Payment Mortgage Calculator For Excel

Extra Payment Calculator Is It The Right Thing To Do

Bi Weekly Loan Calculator Biweekly Payment Savings Calculator

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Downloadable Free Mortgage Calculator Tool

Mortgage With Extra Payments Calculator

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Home Equity Calculator Free Home Equity Loan Calculator For Excel

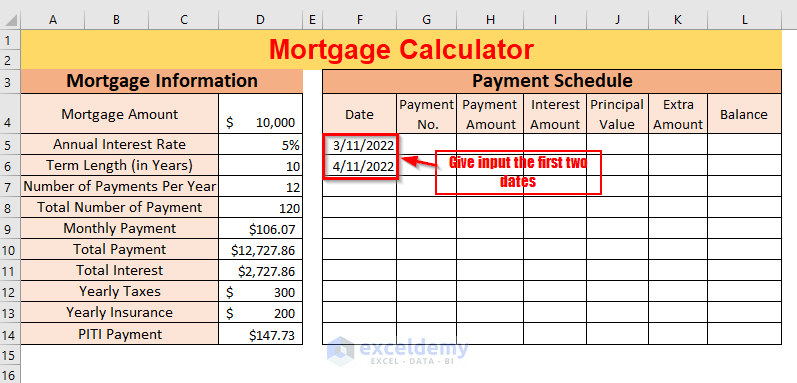

Creation Of A Mortgage Calculator With Taxes And Insurance In Excel

Mortgage Repayment Calculator

Downloadable Free Mortgage Calculator Tool